WHY GOLD

As someone who believes that everyone should own some gold, I'm often asked about why a seemingly insignificant shiny metal has such a drawing for some people, and why the value of it in the 21st century is still very high. The answer to this question is fairly simple, but making sure the hearer of my answer has a good understanding of history and the current financial system, is the difficult part. In my writing below, you'll find my best attempt at explaining this reality, and although it's longer than I would prefer, it contains what I believe to be the bare minimum required to convey the concept of what real money is, and what it isn’t. I hope you're able to find this useful in answering some of the questions you may have surrounding the question of "WHY GOLD"

The History and Future of Gold and Silver

Gold and Silver have been used as a monetary instrument going back to the beginning of recorded history, and most people don’t know, or don’t want to know, why. The case for gold is backed up by 4000 years of history, and there are many resources that are available to help you learn about and fully understand as to why gold has withstood the test of time. My intent with this document is not to go into a lengthy history lesson, but is simply a short presentation that will hopefully open your understanding as to how and why, now, is the time to learn about gold and silver and how you can protect yourself and your family from a currency collapse. Throughout history, every paper currency (Fiat money) around the world has collapsed over time, in exactly 100% of the instances, where the country’s currency was no longer backed by gold. As of 1971, the USA’s government chose to go against their constitution, and stopped backing their currency with gold. After studying this subject for a while, my hope is that you’ll be able to determine for yourself whether or not the masses are being deceived into believing that “this time is different”. you may be one of the few who, during the good times, are willing to learn and understand how gold and silver can protect you financially in times of political distress, and why investing in these two precious metals can play a key role in doing that. When speaking with my clients, I always present the owning of gold and silver as “insurance” more than an investment. Insurance against a currency collapse or financial reset. And just like any other insurance that you will purchase, I’d suggest it’s best to purchase it two years too early, than try to get it five minutes too late. Because when a collapse happens, nobody will be selling their insurance to you, meaning, the prices of gold and silver will be beyond reach for the average person wanting to get in then. I know you probably find these statements unbelievable or even insane, but if you care to truly educate yourself in this field and aren’t afraid to learn something you haven’t fully studied before, then you should find this document an interesting read as to why gold and silver still have a place in the 21st century.

And just before we start, a quick note that Gold and Silver play slightly different roles, but for this presentation, I’ll stick mainly with discussing Gold, as silver follows many of the same principles as gold. For now, just keep this one idea in mind, that as a general rule, countries (central banks) buy and use gold because they’re dealing with very large numbers, and storage of gold simply requires much less space than silver. Whereas people tend to use silver for two reasons, that it’s “cheaper” than gold, and because of its lower price per ox, it’s much better suited for personal day-to-day transactions. Now let’s get started.

First of all, we have to understand the difference between currency and money. Any strong developing economy starts off using money as currency, but as time passes and the leaders get corrupted, they start making currency out of worthless material, known as Fiat Currency. Sound confusing, well, it’s not, once you understand the difference between currency and money.

Now you’ll have to stay with me here, as what I’m about to say will initially sound confusing and over-simplistic at times, but believe me, once you read it over a few times and get the true grasp of the concept I’m trying to describe to you, you’ll have a much truer understanding of the what and why’s of money.

Why do we need Currency, and what exactly is it?

Let’s go back and imagine the time when there was no currency, and let’s say you made shoes for a living. At the same time, I raised cattle, and right now I need a pair of shoes for my daughter. Without currency, we would have a really hard time bartering, as when I showed up at your place with a cow, you don’t want a whole cow, and I don’t want to trade my cow for 100 pairs of shoes. So we need a median of exchange that will allow us to trade what we produced into, then we could easily make the purchases we need, for the amounts of product that we need at the time.

Then here’s a second truth we need to understand before we can start talking about what true money is. When we complete a task that other people are wanting or needing, it is described as “work”. And “work” can be described as the combination of our “time and effort”. So imagine that every day that we work, we could take that “time and effort”, and put it into a container. Then at a later time, when we need something, we can then convert that “time and effort” into just the right amount of product or service that we need at the time.

Now going back to the cow and running shoe example, now that both of us can put our time and effort into a container, I can go pick up just one set of shoes with a small amount out of my container, and vice versa, he can come and purchase a cow when he needs one, with a large amount of the stuff in his container. And yes, now you’ve guessed it, the “containers” I’ve been describing can be better described as “currency”. But I needed you to understand the concept, before we continue on to learn the difference between currency and real money.

Now that you understand why currency is needed, and how it makes our lives easier, let’s look at exactly what currency is, why it must have the complete confidence of everyone using it. This is the most important concept to understand here. Currency, or a median of exchange, must have 7 vitally important properties, if it is to have long and lasting confidence of everyone using it.

- LIMITED SUPPLY – it must be of limited supply. There must be enough of a supply that anyone can possess it, but it must not be something that corrupt people can just go and get a bunch of, without working for it, or can just print or otherwise produce it.

- INTRINSIC VALUE – the currency must be useful to people, outside of being used as a median of exchange.

- DURABLE – as the currency is put in people’s pockets and passed from person to person, it mustn’t easily wear down, or be degraded with prolonged usage.

- PORTABLE – we must be able to easily carry it around in our pockets and purses, but not too small that it can be easily lost or literally “slip through the cracks”

- DIVISIBLE – real currency must be able to be separated, and still be worth that percentage of the whole, of which the piece came from. Or more precisely, if the currency you’re holding can purchase you two bicycles, if you were to cut the currency in half, you could purchase one bicycle today, then one with the other half two weeks from now. Or in more practical terms, what I can purchase with a piece of currency with a 20 on it, I could also purchase with 4 of the currency that had a 5 on it. (4 x 5 = 20)

- FUNGIBLE – this means that it must be worth the same, no matter where you go with it. For example, if 10 of the currency will buy you a sheet of plywood in British Columbia, it should be able to buy me a sheet of plywood in Alberta. The purchasing power that the currency must not be affected by in what region it is being used in. So for an example of something that couldn’t be use for currency as it is not fungible, would be fish. As one fish would be worth much less in areas close to water, as fish would be plentiful, and worth more in places where there were no lakes, and therefore harder to get a hold of.

- NON-INFLATIONARY – the worth of the currency must not go up or down over time, it must be stationary. If we received 100 of the currency for the work we did today, as a true currency and storage of wealth, we should be able to purchase the same services or products with that 100 that we could today, 3 years from now.

As you can see, the currency that we’re using today adheres to only a few of the essential properties for true money, and this is why every country that goes away from using real money as currency is destined for failure and a currency reset, sooner or later. At the end, we’ll go through and learn why gold has always been and always will be real money, but for now, let’s go through the list, and talk about some of the most dangerous areas that we’re failing with our current currency in use today.

Three Major Flaws with Fiat Currency

Fiat Currency, or better known to most people in the 21st century, as money, is currency that is not backed by anything real. It can be, and is printed at the whim of governments. This means that the government can just decide that they want to be twenty billion dollars richer today, then just one email and wallah, it’s done. They now have $20,000,000,000 more dollars to spend on other country’s goods or services. And they don’t even have to spend the time and effort to print the money anymore, as most of it’s done electronically. Don’t you wish you could just do that every day, increase your bank account whenever you wanted? I’m sure you know why that wouldn’t work very well, if everyone could do that, yet that’s exactly what every country in the world is doing right now. This is the main reason why so many of the countries are sick and tired of the USA just creating excessive amounts of money every day, and are working feverously to put an end to it. On the other hand, with a gold-backed currency, for every dollar printed or created electronically, the government has to purchase that exact same dollar amount in gold, and store the gold in their vaults. This process ensures that the government has to be accountable and essentially has to “work” for their money…..just like you and I have to. But with Fiat currency, they don’t, and therein lies the problem and ultimately ends in a currency collapse. The following is the three main problems as to why fiat currency has a finite lifespan, mainly because it fails as meeting the necessary requirement of following the 7 essential properties of Real Money noted that we just talked about.

- Limited Supply – The older I get, the more I have come to realize that life just isn’t nearly as complicated as some make it out to be. When it comes to finances, it should be that the harder you complete a skilled job, and the more time you dedicate to it, the more money you should accumulate. If you work less, and do work that isn’t needed by many people, you should in turn accumulate less money…..very simple economics. But here’s the problem. Both Canada and the USA have for years, printed or created more money…every year they do this. So what they’re doing, is flooding our countries and the world with our currency, which in turn, lowers that purchasing power of each dollar you own or make. Liken this to a game of Monopoly where you keep leaving the room and coming back to the game with more money you’ve just printed off. How long do you think other people are going to want to keep playing with you ? It won’t be very long before the other players call you a cheater and just stop playing. So there must be a limited supply of currency, where everyone knows that everyone else is playing fairly, and is not printing money, just so that they can cheat the other countries out of their work (time and energy). North America has flourished greatly over the last 60 years by printing themselves into wealth, while the rest of the world works very hard, but is not rewarded properly for their work. We are stealing from them, and this is one main reason why so many countries in the world either have already, or are frantically working on stopping the USA dollar as the World Reserve Currency of choice, and are planning on starting a new currency backed by gold.

- INTRINSIC VALUE – You’re probably not aware, that Article I, Section 10, of the USA constitution states the following : “no state…shall make anything but gold and silver coin a tender in Payment of Debts.” I won’t go into detail here about why the founding leaders of the current greatest world power, knew of the great and lasting importance of never having a currency that wasn’t made up of gold or silver, but yes, they knew from history that if a country is to succeed, they must never go away from gold and silver coin currency. But wouldn’t you know it, in both the USA and Canada, as of 1968, the governments started making coinage currency that contain NO GOLD or SILVER.

- NON-INFLATIONARY – In order to have a great and stable financial system, once you have converted you work (time and energy) into money, you must have the confidence that the value of the currency stored up today, will provide you with that same amount of value down the road, when you need to trade it in for a product or service down the road. But in a corrupt financial system, it must steal some of your wealth each month to keep feeding itself. In order to understand this, you much learn to appreciate why you will always hear from your government and financial professionals, that “inflation is good, we need inflation.” But now think about what they’re really telling you. The must have the masses believe that it is a good thing to have your stored up wealth depreciate every single month. I can’t emphasize this enough, that if you have 4% inflation, that means that during that year, the purchasing power that your $10,000 had in January, in December now only has $9600 !! The system just stole $400 of wealth from you. Take those same numbers out to 10 years. After 10 years of 4% inflation, that $10,000 now has the purchasing power of only $6000. That’s a lot of theft. Now take a minute and think about that fact. The governments’ financial system is dwindling your wealth away every single day, and they have the nerve to manipulate people into believing that this is a good thing? This is why a good and honest currency is one that does not depend on inflation to keep it temporarily afloat.

Gold / Silver used as Currency

Let's now look at why for 4000+ years, gold/silver has not just been a game for fools, and why it has throughout history, fulfilled every one of the 7 critical elements of a monetary instrument for us humans to use as a valuable and trustworthy currency. And why some like to call gold and silver “real money”.

- LIMITED SUPPLY – Gold is a rare precious metal, but not extremely rare. It can be found on, and in the earth anywhere in the world…..but you have to work hard to go and retrieve it. So unlike Fiat currency, governments can’t just “create wealth” by turning on the printing presses, which means no matter where in the world you live, one has to work hard to get the gold, and because it’s very sparse, it means that gold is always in Limited Supply. Because of its limited supply, the inhabitants of any country must work hard and find gold. Which ultimately means that the harder they work at getting gold, the more value that can be added to their financial systems’ stability. An interesting fact is that even your body contains a small amount of gold, so love it or hate it, it’ll ever be a part of you.

- INTRINSIC VALUE – if a country’s currency has value within itself, it will always be worth something. Our Fiat currency, or paper money, of today has no intrinsic value. If you travel to the Currency Museum in Germany, you’ll find that every single form of paper money, except for what the countries are currently using, are all totally worthless. Every single one. But then when you travel to the coin section, you’ll find various coinage samples. All the coins where the countries started out containing gold or silver, are still worth money today. But as soon as the countries, just like ours have now done, started producing coins with no gold or silver in them, they are just like the paper money. They might be nice to look at, but they aren’t worth anything. All currency coin that has been made since the beginning of time, that contains gold or silver, are still worth money today…..and that’s the true definitions of Intrinsic Value.

- DURABLE – Gold and Silver are durable metals. In the past, countries most often combined a small amount of other metals with the precious metal, to make the coin last longer. But with today’s minting technology, precious metal coins stand up very well to prolonged usage.

- PORTABLE – with gold coins, a great amount of wealth can be easily carried around on one’s person. For normal day to day transactions, silver coins are more suited for smaller transactions. If I needed to purchase a car today, which cost, let’s say $30,000, it would require only 15 one ounce gold coins, which I could easily put in my pants pocket. Now that’s what I’d call definitely “Portable”.

- DIVISIBLE – if you take a $10 bill out of your wallet right now, and rip it in half, do you think you could go and spend that anywhere? Of course not, because both halves have now become worthless. But if you had a gold or silver coin, and cut it in half, any gold dealer, or individual who know the true realities about gold, would be more than happy to give you approximately half of what that coin was worth, before you cut it in half. And that’s because, the value of the coin is based on truth and honesty. 2 half-ounce gold coins are worth the same as a one-ounce gold piece, or, 4 quarter-ounce coins, etc. This is why gold and silver coins are truly Divisible.

- FUNGIBLE – if you try taking a $100 Canadian dollar bill to any other country in the world, you will not be able to purchase anything with it. But now if you tried doing that with a one ounce Canadian Maple Leaf coin, you will find that it is accepted virtually everywhere around the globe. And the purchasing power that you had with that coin back in Canada, will be much the same as you will have in the country you’re visiting.

- NON-INFLATIONARY – not only is Gold non-inflationary, most of the time it is actually deflationary. Just look at its value since my birth year, 1967. In that year, a coin dollar was worth a dollar, a paper dollar was worth a dollar, and a one ounce coin was worth $35. TODAY, that $1 coin is worth $12(only because it contains $12 worth of silver), that paper dollar bill is still only worth a dollar(because it is Fiat Currency), and that 1 ounce gold coin, well as of today, November 16, 2019, it’s worth $1959 CND( only because it contains gold). Let me put that a different way, let's say you’re parents had put aside $5000 for you back in 1967 as a baby gift, and then surprised you with it now, some 50 years later. Which form would have you preferred they had saved it in. Well let me do the math for you. If they had put five thousand one dollar bills, today you would have been presented with $5000, which has a lot less purchasing power than it did back in 1967. On the other hand, let’s say they had collected five thousand, $1 coins. Today, they would be presenting you with 5000 coins that you could bring to me and cash them in for $60,000. And that’s only because the coins in 1967 contained silver, and silver is real money. Now for gold…… If your parents had purchased 143 gold one ounce coins with that $5000, today you could sell those coins to any gold dealer for $277,420. That’s over a quarter million dollars profit. Hopefully from this example, you can now understand why paper Fiat currency is inflationary, and why gold and silver are deflationary, which means, as time goes by, the purchasing power that your gold has, will actually increase over time. Overt time, Fiat paper money goes down in true worth, where as gold and silver go up in true worth. Throughout history, gold and silver has ALWAYS maintained or increased your purchasing power, whereas paper money decreases your purchasing power. Oh, and by the way, if your parents had waited till 1968 to save those $1 coins for you, instead of the $60,000 you would get for the 1967’s, you would only get the $5000, because that’s when Canada started making coins with no silver content.

PUTTING IT ALL TOGETHER

By now, I hope you have a better understanding that true money is a monetary instrument that is a storage of your wealth. And for an honest financial system to be sustainable, it’s best, if the currency meets all seven of the criteria for sound money. Throughout history, gold and silver has always been the only thing that ultimately proves it has what it takes to be real money.

Historically, one ounce of gold has always been equal to roughly two weeks of an average persons' work, and an ounce of silver, equal to between a half hour to one hour of an average persons' work. In today’s numbers, an ounce of gold in Canada is worth just under $2000, and an ounce of silver is right around $24. As our paper(fiat) money gets devalued through inflation, those numbers will continue to go up. That is, as long as the last 4000 years of history continue to have a say in anything. But right now, you may like to pose the question to me, as to exactly WHY I believe the current North American system is destined for failure, well here is the best explanation of where I believe we are in the financial power cycle, and why I believe its demise is immanent.

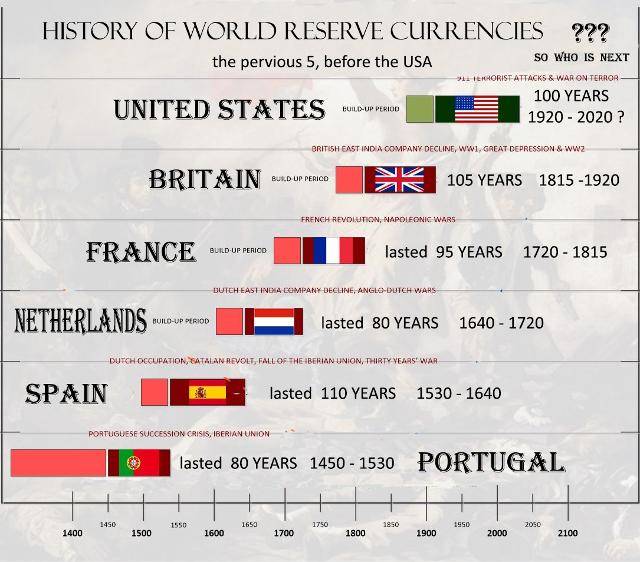

When someone or a group of people feel entitled and believe they truly are better than the rest, it always leads to their ultimate downfall. Any wise person knows of this reality very well. That same principle also applies to countries. If you have a look at the graph below which goes back to the 1400’s, you’ll see that it shows which countries have been the worlds’ financial stronghold, and how long each country has kept their status, before they become corrupt and are were toppled by a new and trustworthy one. You may be surprised to see that the average life-span for a financial superpower is right around 100 years. Now take a close look at the time frame for the USA, as they are right at the end of that historical 100 year maximum reign point.

The USA is following in the footsteps of every other super power that has fallen, namely the over-printing of their currency, going into unimaginable amounts of debt as they foolishly believe they can “spend their way out of debt”, and have persuaded almost everyone in their country to “sit back and enjoy life, because this can go on forever.”

Yes, in our lifetime, we have always known the USA as the world leader. But I’m hoping you might see that this familiarity has skewed our thinking into the belief that “what always has been (in our lifetime), will always be”. But don’t be deceived, as history tells of a different future in store for us, of a soon coming change to the current world order.

And finally, let me say that every now and then, deceivers will produce and try selling to the masses, a new cure-all “snake oil” that is intended to deceive many into believing that they have a great new solution to all the problems out there. This “solution” is the next best thing and they’ll claim it’s truly “better than gold”……. By chance, have you heard anything like that being proclaimed from the rooftops lately? They will also mock the truth about gold which is backed by 4000 years of history, and tell you that physical gold and silver are for the misinformed doomsayers’, or for the unintellectual who aren’t smart enough to know any better.

But my hope for you is that, after reading this and getting a small glimpse into the past, that you’ll be stirred to dig deeper into the historical reasons as to why gold and silver have withstood the test of time to store up wealth, and protect people through times of unrest and financial collapses. And once you’ve done that, if you at that point fail to believe that investing into physical gold and silver is not a smart move, then that’s perfectly fine. But at least you were willing to educate yourself on the subject, and I guarantee you would have benefited from something you learned along the way.

Respectfully Submitted